Some Items Of Note As We Head Into An Earnings Driven Gap Up Tomorrow

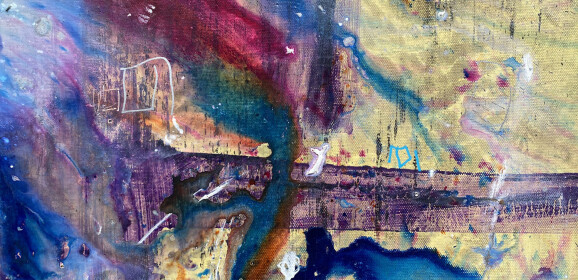

Let's begin with this chart of the SPX: The lowest print for April was 4069.84 on the SPX. Today we closed at 4071.63, effectively testing the bottom end of April's range for the SPX. With the threat of an earnings catastrophe after the close paired with the worst demonstration of price action today in sometime, it became a natural reflex for investors to grow pessimistic as the selling progressed throughout the day. The equity put/call ratio pictured below is a glowing testament to the infectious nature of the short-term pessimism. We have to go back to the March lows when the SPX hit 3808 to find a equity put/call ratio that exceeded what we experienced today as we basically tested the levels that marked the March HIGHS. Needless to say, today's price action ahead of GOOG and MSFT earnings trapped a significant population of investors into thinking that this week would be like last week. We found out after the close that GOOG and MSFT are not NFLX and TSLA. We will further find out in the days ahead that AMZN, AAPL and META are also not NFLX and TSLA. While I expect this week to remain volatile, the volatility should give way to a steady rise once mega-cap tech earnings are fully digested past Thursday's close. Risk on remains the default stance for sometime to come despite the market's insistence to convince you otherwise. Zenolytics Turning Points is 300+ editions in and only getting better. Find out why institutions and individual investors have come to depend on our service through each and every type of market environment. Click here for details. Disclaimer This website is for informational purposes only and does not constitute a complete description of our investment advisory services. No information contained on this website constitutes investment advice. This website should not be considered a solicitation, offer or recommendation for the purchase or sale of any securities or other financial products and services discussed herein. Viewers of this website will not be considered clients of T11 Capital Management LLC just by virtue of access to this website. T11 Capital Management LLC only conducts business in jurisdictions where licensed, registered, or where an applicable registration exemption or exclusion exists. Information contained herein is not intended for persons in any jurisdiction where such distribution or use would be contrary to the laws or regulations of that jurisdiction, or which would subject T11 Capital Management LLC to any unintended registration requirements. Visitors to this site should not construe any discussion or information contained herein as personalized advice...

Here Is The Call Heading Into CPI Tomorrow

None of this is a coincidence with CPI, PPI and Fed minutes being imminent: SPX 4109 BTC 30300 10 year yields 3.4% DXY nearing 100 VIX below 20 All of these key indicators of capital flows are telling us that something has indeed flipped in recent weeks. While most are still stuck in a narrative of recession, bank failures, stagflation and geopolitical turmoil, the market is focusing on something else entirely. It's not our job to be psychics as investors, pinpointing what that "something else" could be. Our job as investors is to recognize when price momentum and structure is of the type that is significant enough that it dictates shutting down all emotional traits associated with following group think, and following the smoke signals that price is clearly emitting in the near distance. If you will recall, in mid-January with the SPX at 4000, I detailed how investors were focused on the incorrect price levels around 4000, with 4100-4200 being the true point of interest for the markets. 4200 came in early February, stopping the markets cold in their tracks. Investors had their eye on the incorrect target. Now here we are again, the same mistake is being made. The SPX has a point of interest at 4300, constituting either resistance (down) or an acceleration zone (up). 4100-4200 no longer matters. The goalposts have been moved. With that said, for the remainder of this week investors are contending with a bunch of scary economic events (CPI, PPI and Fed minutes) along with perceived technical resistance areas (4100-4200) that carry little weight. This combination of factors will allow for the markets to quickly move up for the remainder of this week on the back of economic data that will reignite discussions of a dovish pivot. 4300 tells us what the next steps will be. Zenolytics Turning Points is 300+ editions in and only getting better. Find out why institutions and individual investors have come to depend on our service through each and every type of market environment. Click here for details. Disclaimer This website is for informational purposes only and does not constitute a complete description of our investment advisory services. No information contained on this website constitutes investment advice. This website should not be considered a solicitation, offer or recommendation for the purchase or sale of any securities or other financial products and services discussed herein. Viewers of this website will not be considered clients of T11 Capital Management LLC just by virtue of access to this website. T11 Capital Management LLC only conducts business...

The Confidence Game In The Nasdaq That Has Everyone Convinced

There is a confidence game taking place on Wall Street right now. Most everyone is presently convinced that lower interest rates are generally a bullish signal for equities, growth equities especially. Irrespective of how those lower interest rates are derived or whether they are subject to illiquid conditions while piling on record amounts of short interest prior to the run in bonds makes little difference. Lower interest rates mean that it's safe to buy growth equities. We saw an example of this in real time today, as the Nasdaq started the day going significantly lower, but the appeal of lower rates on the day caused a stampede into tech names by the close, reversing the earlier losses. At the same time, investors are beginning to believe that tech has become a flight to safety trade, as rates have cratered and the reversals, almost daily this week, have been very convincing in nature. The fact that the markets have only recently started playing this confidence game, with this week having the added bonus of lower interest rates to drive home the point that tech is generally safe is a precursor to chaos in the sector. This is the manipulation of psychology in the markets at work in real time. The attempt by the market to create paths of least resistance before the statistically significant moves take place. The only way to do this is to convince investors that a certain reality is concrete. They can't lose or have a very small chance of loss. Risk is seemingly minimal. Investors piled into growth today, being manipulated into thinking they are now safe because rates have recently tanked, while technology continues to demonstrate relative strength on a consistent basis. The market is going out of its way to drive this point home as demonstrated by the last 3 days of trading in the Nasdaq 100. Similar to mid-February before the Nasdaq began to descend in earnest, what we have seen in mid-March are 3 days in a row of closes at or near the daily highs, with the opening tick being near the lows. This is the confidence game of the markets at work. This the market attempting to convince investors it is safe to step back into the water at the worst possible time. Markets don't go out of their way to put together patterns like this without intention. Guaranteed that this intention doesn't involve handing bags of cash to the average investor who believes that growth HAS to go up when rates drop while believing in the growth safety trade mirage that has emerged in recent days. Another trap...

Here Is The Call Going Into Tomorrow’s Job Report

We are in for a string of hotter than expected economic reports, starting with the jobs reports tomorrow morning. At least, that is what the bond market is suggesting if you are to take into account that the short end of the curve has gone vertical in recent weeks. Of course, there are many who seem to attribute the recent rate surge to the markets getting their panties in a bunch over "seasonal blips" in recent economic reports. This type of dismissive optimism has kept the markets elevated, despite the fact that yields are commanding a much lower floor for equities presently. With that said, the dismissive optimism of the past few weeks is about to turn into reluctant acceptance that there is a good chance we are now facing a second leg of inflationary pressures. Tomorrow begins the trek down to the 3700 range, which is where the markets are likely to end up right as the March FOMC meeting kicks off a little less than two weeks from today. There is a confluence of support beginning at SPX 3750 down to 3630. All of these support levels will be hit in the weeks ahead. It will be enough, however, for the SPX to move down to around the 3700-3750 mark by the 21st of March. Expecting a hotter than expected NFP number tomorrow and I expect that today's volatility will only be expanded upon to the downside into the end of this week. We remain short after adding to our short exposure on Tuesday. Goodnight. Zenolytics Turning Points is 300+ editions in and only getting better. Find out why institutions and individual investors have come to depend on our service through each and every type of market environment. Click here for details. Disclaimer This website is for informational purposes only and does not constitute a complete description of our investment advisory services. No information contained on this website constitutes investment advice. This website should not be considered a solicitation, offer or recommendation for the purchase or sale of any securities or other financial products and services discussed herein. Viewers of this website will not be considered clients of T11 Capital Management LLC just by virtue of access to this website. T11 Capital Management LLC only conducts business in jurisdictions where licensed, registered, or where an applicable registration exemption or exclusion exists. Information contained herein is not intended for persons in any jurisdiction where such distribution or use would be contrary to the laws or regulations of that jurisdiction, or which would subject T11 Capital Management LLC to any unintended registration requirements. Visitors to this site should...

Here Is The Call As We Head Into The Powell Testimony Tomorrow

Remember Jackson Hole? I've highlighted the S&P price movement headed into Jackson Hole, as well as where we stand today in the below chart. As we headed into Jackson Hole, the sentiment with respect to Powell was unconcerned according to the put/call ratio. I've also highlighted the seemingly unconcerned state of the current investor population with respect to Powell's testimony tomorrow in the chart of the put/call below. Why does this matter? A consistent theme of the current Fed obsessed market has been that when the markets are unconcerned with Powell, downside becomes the predominant trend following his speech. When the markets are overly-concerned, a rally ensues. Despite the fact that economic data has come in hotter than expected following Powell's last public speech in early February, investors seem to be in the camp that he will go against his own word of being data dependent in his decisions, with investors primarily relying on Powell determining that the PPI, CPI and jobs are all seasonal blips. Additionally, tomorrow he is up against a group of fire breathing politicians who are being harassed by their constituents with respect to inflationary pressures compromising the earning power of the average American. Politicians want votes. Powell will be the punching bag. In the face of this, with increasingly obvious signs of a pickup in inflation and with no slowdown in the economy in sight, Powell will be reluctant to strike a dovish tone. All this while the markets have rinsed bears over the past few days via a short squeeze that leaves the market hollow, vulnerable and compromised into severe selling pressure should he strike a hawkish tone in a pattern that looks an awful lot like the early September peak following the August high. Last week's low of 3928 is up for grabs this week. Look for the 3700 range to arrive at some point prior to the late March FOMC. Zenolytics Turning Points is 300+ editions in and only getting better. Find out why institutions and individual investors have come to depend on our service through each and every type of market environment. Click here for details. Disclaimer This website is for informational purposes only and does not constitute a complete description of our investment advisory services. No information contained on this website constitutes investment advice. This website should not be considered a solicitation, offer or recommendation for the purchase or sale of any securities or other financial products and services discussed herein. Viewers of this website will not be considered clients of T11 Capital Management LLC just by virtue of access to this website. T11...

Market Flat Line

There is a lot to the technical picture right now that most seem to be missing, while placating themselves with largely irrelevant, ill-timed and incoherent data points that are misguided, for lack of a better term. Here is the most obvious example from just today with AAPL. This is endemic in the markets presently. Important market averages and individual names are casually moving beneath their 200 day moving average as if it isn't there. Basically, this is the markets version of shocking a patient who is in cardiac arrest with no response. AAPL is flat lining. It's not 1, 2 or 10 names/indices that doing this. It is everywhere. By the end of this week, the S&P 500 should join the flat liners, although it is, at least, trying to put up a fight. I expect that by tomorrow that fight will be over, with the S&P moving beneath 3900 to end this week. Getting short and only adding to shorts since the beginning of February, after being heavily net long since October was not as difficult as it may seem if you are observing the correct price levels. Zenolytics Turning Points is 300+ editions in and only getting better. Find out why institutions and individual investors have come to depend on our service through each and every type of market environment. Click here for details. Disclaimer This website is for informational purposes only and does not constitute a complete description of our investment advisory services. No information contained on this website constitutes investment advice. This website should not be considered a solicitation, offer or recommendation for the purchase or sale of any securities or other financial products and services discussed herein. Viewers of this website will not be considered clients of T11 Capital Management LLC just by virtue of access to this website. T11 Capital Management LLC only conducts business in jurisdictions where licensed, registered, or where an applicable registration exemption or exclusion exists. Information contained herein is not intended for persons in any jurisdiction where such distribution or use would be contrary to the laws or regulations of that jurisdiction, or which would subject T11 Capital Management LLC to any unintended registration requirements. Visitors to this site should not construe any discussion or information contained herein as personalized advice from T11 Capital Management LLC. Visitors should discuss the personal applicability of the specific products, services, strategies, or issues posted herein with a professional advisor of his or her choosing. Information throughout this site, whether stock quotes, charts, articles, or any other statement or statements regarding capital markets or other financial information, is obtained from sources which...

Weekly Note Preview: What The Numerous Distribution Patterns Popping Up Mean For The Markets During The Weeks and Months Ahead

In this weekend's 328th edition of Turning Points we have a 16 page note going over the numerous distribution patterns showing up in the market after nearly two years of sideways consolidation and what they could mean for the weeks and months ahead. What follows is an excerpt from this weekend's note. MARKET UPDATE During times like this, the best course of action is always to simplify to the greatest degree possible. It doesn't get any simpler than the chart of the S&P 500. For this chart, I have intentionally highlighted the 4200-4350 level. More specifically, the resistance envelope (red, gray, white trajectory lines) that exists in that range. More than anything else, this highlights a very real problem for the markets moving forward. I'll explain why. First, here is the chart: I have purposely lightened a majority of the technical support/resistance points on this chart so that the red and white trajectories stand out. You will immediately notice on this weekly chart that going back to December 2018 (the infamous taper tantrum), March 2020 (pandemic panic) and 2022, whenever this series of trajectories has broken from above, the markets have become extremely slippery, extremely fast. These trajectories go back to 2008/2009, carrying quite a bit of weight for the entirety of this bull market. They are extremely relevant, in other words. I have been discussing speed and time being of the essence for the markets since the beginning of this year. The S&P chart above and more specifically, the manner in which the market is consolidating below the red and white trajectory points is the reason. For example, you can see that during the December 2018 panic, the market realized time was of the essence, quickly regaining the trajectory. You can see that during the March 2020 panic, the market realized time was of essence, quickly regaining the trajectory, despite moving well below it during the pandemic crash. This time is very different, however. Investors are not bidding up the markets in a frenzied fashion as they have in the past. Instead they are slowly distributing stock over time. A distribution pattern. And it's a very significant one, in fact. The significance comes from where it is occurring along with the length of time that it is taking. The breakdown of such a pattern carries technical consequences that are extreme in nature. To view the entirety of this weekend's note, you can subscribe by clicking here. Zenolytics Turning Points is 300+ editions in and only getting better. Find out why institutions and individual investors have come to depend on our service through each and every type of...

Detailing Our Decision To Get In Cash or Net Short

For the first time since the September/October time period, Zenolytics portfolios have moved to a net short position. This is after being upwards of 200% long throughout the majority of January, taking advantage of primarily growth stocks with one crypto in particular (RNDR) giving us a 150% gain since August. We are out of everything, but a couple long-term crypto names. Our portfolio of growth stocks has done what it was meant to do. That is to produce a furious snap back rally, riding on the back of short sellers, investors who were forced to take exposure into the new year, and dreadfully misallocated portfolios that were built on fear of Q1 2023 being a replay of Q1 bear market action in 2001 and 2009, as two examples. During this past weekend I put out an 18 page report to clients with 17 charts detailing why, at a very minimum, it is time to be conservative with overall exposure to risk assets. There are a number of factors involved in completely flipping our exposure this quickly, some of which are macro based, but most of which are technically based. The bottom line is this: The markets are well behind schedule. I have been emphasizing in recent weeks that speed is of the essence moving forward. This from January 10th, with the SPX at 3900: This past Thursday we hit 4195 and reversed. The fact we are sitting around 4100 is now a problem. This is the same vicinity the S&P 500 was during Powell's now infamous Jackson Hole speech on August 26th, 2022. Two days before Powell spoke at Jackson Hole, the SPX was at nearly the exact same levels as prior to his speech tomorrow (today depending on where you are). We have made no progress despite an abundance of clarity with respect to inflation and the Fed since the August Jackson Hole speech. The markets are looking at something else. It's a guessing game right now as to what that is, with macro analysts coming up with everything from earnings to more rate hikes than anyone expects. We don't necessarily need to know exactly what the market is looking at to delay making substantial progress. The fact that the delay is taking place, while numerous rejections take place along key resistance points in all types of major averages is enough to step back. Investors must now demand clarity from price before further committing to a market that has seen a significant shift from extremely bearish to quite bullish in just a few weeks. On...

Here Is Where We Stand After Today’s Decline

Disbelief in this rally is running rampant. That disbelief, however, does not preclude the market from putting in days like today. We took off our leverage for the first time in quite awhile on the open, suspecting that this week would be a volatile one in both directions. That volatility gives rise to opportunity, which is why a cash position was necessary to capitalize on the events to come. The buy zone (highlighted in yellow below) should arrive by Wednesday, if the market decides to be so gracious as to afford investors the opportunity for another dip before heading up to 4200 on the S&P and 13000 on the NDX. Far too many traders are looking for a retest of the now infamous downtrend line from the 2022 highs. This makes the signal far less relevant than it would be otherwise. In fact, if the NDX does test 11450 this week then the bulls have a real problem on their hands going forward. I'll detail this further if it does occur, but for the time being it doesn't necessarily warrant discussion as it's a low probability scenario this week. At maximum, the downside from today is to the 11550-11750 level. This is your buy zone for the week. The more shallow the pullback from these levels, the higher the probability of catapult type action back up to 13000 within the next two weeks. A move to 11750, followed by a quick rebound back above 12000 would be ideal for the 13000 scenario to come to fruition into the middle of February. Watch your levels. More importantly, watch how the market treats these levels over the next few days as a signal for just how great the momentum on the upside will be in the days and weeks ahead. Goodnight. Zenolytics Turning Points is 300+ editions in and only getting better. Find out why institutions and individual investors have come to depend on our service through each and every type of market environment. Click here for details. Disclaimer This website is for informational purposes only and does not constitute a complete description of our investment advisory services. No information contained on this website constitutes investment advice. This website should not be considered a solicitation, offer or recommendation for the purchase or sale of any securities or other financial products and services discussed herein. Viewers of this website will not be considered clients of T11 Capital Management LLC just by virtue of access to this website. T11 Capital Management LLC only conducts business in jurisdictions where licensed, registered, or where an applicable registration exemption or exclusion exists. Information contained herein...

There Is A Change In The Air

I present you the ratio of Bitcoin to long-term yields: Risk went off at the flip of the calendar from 2021 to 2022 when yields signaled a choking off of liquidity relative to Bitcoin. As we recently flipped the calendar again, from 2022 to 2023, we get another signal. This time telling us that liquidity is returning to the financial markets as Bitcoin is rising relative to yields, breaking out of the downtrend from the 2021 high. Risk assets want to breathe. Targeting SPX 4200 and Bitcoin 29000 in the short-term. Zenolytics Turning Points is 300+ editions in and only getting better. Find out why institutions and individual investors have come to depend on our service through each and every type of market environment. Click here for details. Disclaimer This website is for informational purposes only and does not constitute a complete description of our investment advisory services. No information contained on this website constitutes investment advice. This website should not be considered a solicitation, offer or recommendation for the purchase or sale of any securities or other financial products and services discussed herein. Viewers of this website will not be considered clients of T11 Capital Management LLC just by virtue of access to this website. T11 Capital Management LLC only conducts business in jurisdictions where licensed, registered, or where an applicable registration exemption or exclusion exists. Information contained herein is not intended for persons in any jurisdiction where such distribution or use would be contrary to the laws or regulations of that jurisdiction, or which would subject T11 Capital Management LLC to any unintended registration requirements. Visitors to this site should not construe any discussion or information contained herein as personalized advice from T11 Capital Management LLC. Visitors should discuss the personal applicability of the specific products, services, strategies, or issues posted herein with a professional advisor of his or her choosing. Information throughout this site, whether stock quotes, charts, articles, or any other statement or statements regarding capital markets or other financial information, is obtained from sources which we, and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Neither our information providers nor we shall be liable for any errors or inaccuracies, regardless of cause, or the lack of timeliness of, or for any delay or interruption in, the transmission thereof to the user. With respect to information regarding financial performance, nothing on this website should be interpreted as a statement or implication that past results are an indication of future...