- The nature of price action has changed. Everyone has missed it.

- Bidders have become persistent in their demand for growth names for the first time since the 2021 market top.

- Anyone labeling this as a bear market rally doesn't understand market cycles, specifically, as it relates to the nature of secular bull markets.

- As secular bull markets rise so does the volatility as more participants jump on the train, causing it to sway in a much more dramatic nature than when there were only a few onboard.

- I expect the volatility in 2022, when all is said and done, to be nothing short of shocking, with the upside that is to come being the more shocking aspect of it.

- There is a good possibility that everything we consider as facts, whether inflation, Fed intentions or growth in economy related is completely wrong. This will become apparent in the next 6-9 months.

- If you believe a recession is coming in 2023, then every single bear will need to be annihilated before prices for equities succumb to the effects of negative growth.

- In order to get every single bear to capitulate, prices well above S&P 5000 are required. And when I say well above, I mean WELL above.

- Alt crypto names are beginning to put in some fantastic bottoming patterns, I will be covering these in the weekly report.

- Select software names are also beginning to put in patterns that look like 100% gainers through 2023. I will be covering this in the weekly report, as well.

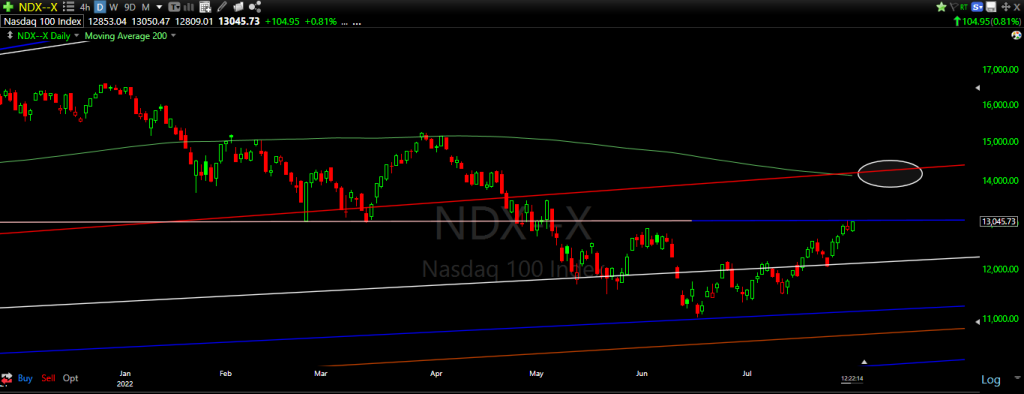

- The NDX will be hitting 14000 in August.

sss

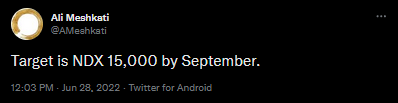

- They scoffed when I Tweeted this in June

Disclaimer

This website is for informational purposes only and does not constitute a complete description of our investment advisory services. No information contained on this website constitutes investment advice.

This website should not be considered a solicitation, offer or recommendation for the purchase or sale of any securities or other financial products and services discussed herein. Viewers of this website will not be considered clients of T11 Capital Management LLC just by virtue of access to this website.

T11 Capital Management LLC only conducts business in jurisdictions where licensed, registered, or where an applicable registration exemption or exclusion exists. Information contained herein is not intended for persons in any jurisdiction where such distribution or use would be contrary to the laws or regulations of that jurisdiction, or which would subject T11 Capital Management LLC to any unintended registration requirements. Visitors to this site should not construe any discussion or information contained herein as personalized advice from T11 Capital Management LLC. Visitors should discuss the personal applicability of the specific products, services, strategies, or issues posted herein with a professional advisor of his or her choosing.

Information throughout this site, whether stock quotes, charts, articles, or any other statement or statements regarding capital markets or other financial information, is obtained from sources which we, and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Neither our information providers nor we shall be liable for any errors or inaccuracies, regardless of cause, or the lack of timeliness of, or for any delay or interruption in, the transmission thereof to the user. With respect to information regarding financial performance, nothing on this website should be interpreted as a statement or implication that past results are an indication of future performance.