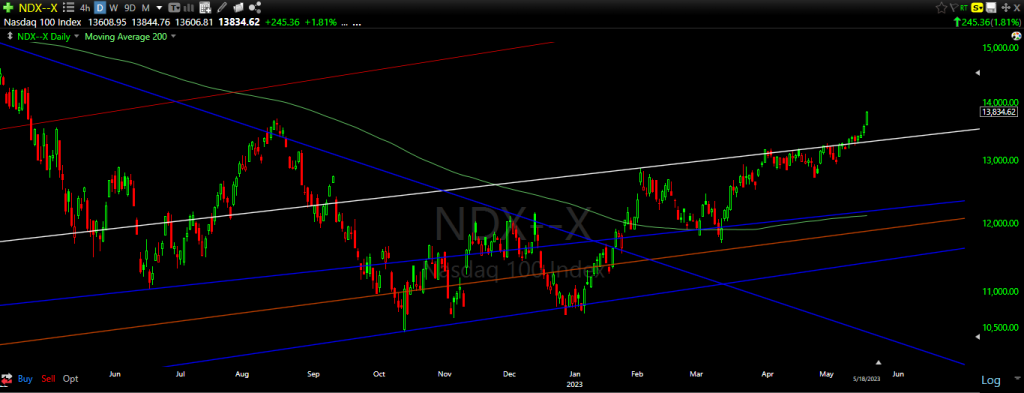

Here is the chart of the NDX as it accelerates away from a near 30 year trajectory (in white) that has acted as critical support/resistance for what has basically been a majority of the life of the Nasdaq 100 as an index.

It has been a year now since the Nasdaq has been consolidating in, around, over and under the the key resistance point that we just blew away this week.

The Nasdaq further confirmed the legitimacy of the move by exceeding the critical 13720 level.

Why 13720? It was the August 2022 peak. That August peak ushered in a whole new regime of inflationary worries with further uncertainty about how long the Fed would continue their rate hiking campaign.

This has been resolved as of today.

The move we have seen in the Nasdaq this week is the most important technical move of 2023 to date.

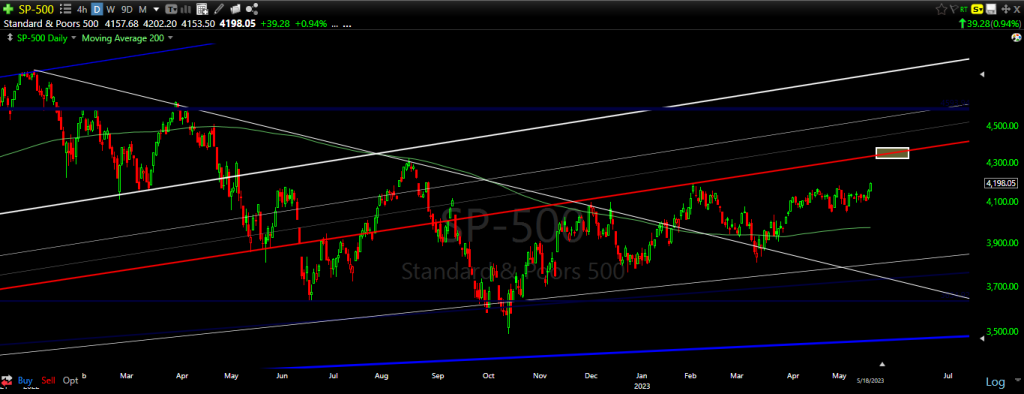

There is, however, a level upcoming on the S&P 500 that is even more critical than the 30 year trajectory on the Nasdaq 100.

The red trajectory that currently sits at 4350 for the SPX is important for multiple reasons.

First, it has been a key point of contention for the market for all of 2023. In fact, the technical reversal at the February highs off of this key technical level was why we went bearish at that those highs until the end of March when we switched back to the bull side.

Secondly, exceeding the red trajectory puts the SPX in the midst of a series of key technical levels that will be prove to be a real test for the market. How it treats this impending test will give us a ton of price data revealing the strength and voracity of this baby bull run.

Third, the first step to new all-time highs for the S&P begins at 4350. Not many technicians, if any at all, realize this fact. For this reason, accurately gauging how the market reacts to the 4350 level will be a huge advantage for those who interpret the markets correctly from there.

We are presently in the midst of the first consequential set of price moves for 2023. In fact, what we are experiencing presently is the first set of consequential market moves not just for 2023, but since the middle of 2022, as well.

The stakes have been raised considerably.

Interpret what you see from this point forward wisely.

Zenolytics Turning Points is 300+ editions in and only getting better. Find out why institutions and individual investors have come to depend on our service through each and every type of market environment. Click here for details.

Disclaimer

This website is for informational purposes only and does not constitute a complete description of our investment advisory services. No information contained on this website constitutes investment advice.

This website should not be considered a solicitation, offer or recommendation for the purchase or sale of any securities or other financial products and services discussed herein. Viewers of this website will not be considered clients of T11 Capital Management LLC just by virtue of access to this website.

T11 Capital Management LLC only conducts business in jurisdictions where licensed, registered, or where an applicable registration exemption or exclusion exists. Information contained herein is not intended for persons in any jurisdiction where such distribution or use would be contrary to the laws or regulations of that jurisdiction, or which would subject T11 Capital Management LLC to any unintended registration requirements. Visitors to this site should not construe any discussion or information contained herein as personalized advice from T11 Capital Management LLC. Visitors should discuss the personal applicability of the specific products, services, strategies, or issues posted herein with a professional advisor of his or her choosing.

Information throughout this site, whether stock quotes, charts, articles, or any other statement or statements regarding capital markets or other financial information, is obtained from sources which we, and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Neither our information providers nor we shall be liable for any errors or inaccuracies, regardless of cause, or the lack of timeliness of, or for any delay or interruption in, the transmission thereof to the user. With respect to information regarding financial performance, nothing on this website should be interpreted as a statement or implication that past results are an indication of future performance.