When we last left off, I discussed the week of June 12th marking a short-term high for the SPX after coming eye to eye with key resistance at 4350. With the SPX putting in its worst weekly performance since early March this past week, it's fair to say that we are seeing the response I expected to this resistance level which now allows investors to judge the health of the markets after this recent runup, along with the potential for further gains.

In the same note I referenced above, I discussed the first week of July being the time to pounce on the long side after the coming pullback.

In the 354th edition of Turning Points this weekend I discussed the signals the market is sending following this recent pullback, along with why those signals are dictating increased long exposure into the middle of July, at the very least.

The current consolidation at resistance is like nothing we have seen since the peak in late 2021/early 2022. In fact, this past week was such a data driven technical bonanza for the bulls that it's not entirely outrageous to say that a vertical ascent could take place into earnings season.

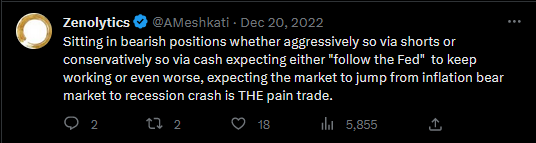

The fear of missing out that will develop into early Q3 as investors fear a replay of their Q2 brain fart to remain short or in cash way longer than they should will be reason enough for a flamethrower to ignite the fuse of the market during what is a seasonally favorable period into mid-July. Unfortunately for such a large number of investors, one of my final tweets for 2022 still holds true, even after this recent runup.

The other reason investors will be frothing at the mouth after stocks as we kick off Q3 is that Q1 earnings delivered such spectacular results that within a generation of front-runners, there will be a cold, hard sprint to get ahead of the next man to buy some stock prior to Q2 earnings being released.

So essentially we have the perfect combination of technical, seasonal and event driven factors coming into fruition as we close out Q2 and enter Q3.

Levering up with a mix of small-cap and large-cap names in the days ahead.

Horns up. Paws down.

Zenolytics Turning Points is 300+ editions in and only getting better. Find out why institutions and individual investors have come to depend on our service through each and every type of market environment. Click here for details.

Disclaimer

This website is for informational purposes only and does not constitute a complete description of our investment advisory services. No information contained on this website constitutes investment advice.

This website should not be considered a solicitation, offer or recommendation for the purchase or sale of any securities or other financial products and services discussed herein. Viewers of this website will not be considered clients of T11 Capital Management LLC just by virtue of access to this website.

T11 Capital Management LLC only conducts business in jurisdictions where licensed, registered, or where an applicable registration exemption or exclusion exists. Information contained herein is not intended for persons in any jurisdiction where such distribution or use would be contrary to the laws or regulations of that jurisdiction, or which would subject T11 Capital Management LLC to any unintended registration requirements. Visitors to this site should not construe any discussion or information contained herein as personalized advice from T11 Capital Management LLC. Visitors should discuss the personal applicability of the specific products, services, strategies, or issues posted herein with a professional advisor of his or her choosing.

Information throughout this site, whether stock quotes, charts, articles, or any other statement or statements regarding capital markets or other financial information, is obtained from sources which we, and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Neither our information providers nor we shall be liable for any errors or inaccuracies, regardless of cause, or the lack of timeliness of, or for any delay or interruption in, the transmission thereof to the user. With respect to information regarding financial performance, nothing on this website should be interpreted as a statement or implication that past results are an indication of future performance.