The general theme I attempted to convey more than any other during 2018 was that everything changed this year.

In fact, before I started sounding the horn on how different 2018 and beyond would be, I penned a note about why the markets would generally suck for the remainder of 2018, calling for the S&P to hit 2,200 at some point this year. While we got close to 2,200 last week, the bottom for the S&P was 2,346.

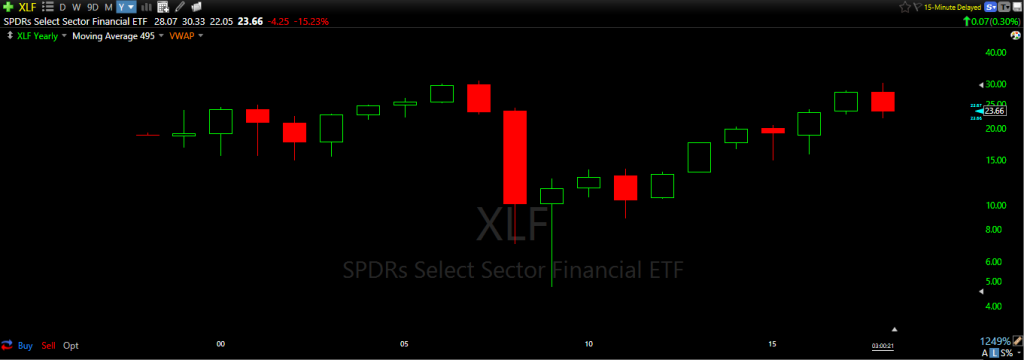

Financials were cause for concern basically all year. In February, I discussed why financials were setting up to lead the market down in 2018, highlighting the fact that all of 2017's gains could be erased in 2018.

Here is the yearly chart for the XLF (financials ETF) showing that all of 2017's gains in financials were erased in 2018.

In April, I called for exponentially higher prices in crude oil. A call that was abhorrently incorrect. Energy has so many geopolitical cross-currents that I have always found gauging its price movement a difficult endeavor. It's one of the few sectors I refuse to trade as a result.

One area that I have made a recent u-turn is with respect to my bullishness on private equity names, specifically KKR. Whatever economic ills may strike in 2019, private equity is ill-suited to deal with the confluence of difficulties that lie ahead. In May I said that KKR has long-term compounder written all over it. I no longer believe that to be the case.

In July, I discussed how all of Wall Street was being herded around the FANG names, in preparation for mass slaughter. It goes to show that whenever Wall Street has everybody on one side of the fence, it's most likely because they want everyone to be set on fire simultaneously, with the least amount of effort to empty individual coffers of capital.

More recently, I made the case for owning gold stocks. Republishing a research report sent to my investors in our November letter. December was the best month for gold in two years. That trend of outperformance is set to accelerate in 2019 as gold is literally in the perfect spot where all roads lead to higher prices.

I was premature in my bullishness for the markets in December, believing that the back end of the month would see substantially higher prices, with the popular averages ending the month in the green. That was very obviously incorrect. I was also incorrect in believing that that the window for a sustainable rally had closed, as discussed in this note on Christmas day.

So now that we know that everything did change in 2018; financials led the markets lower; FANGs ended up sucking in everybody only to pummel them into an unrecognizable ball of bloody sheep innards and the markets have frightened most everyone into believing that a repeat of 2008 or worse is inevitable, it's time to take the road less traveled once again.

The buying opportunity here for technology, in particular, is one of the best over the past decade. Whether this assessment of risk/reward ends up being something that lasts one quarter or the entirety of 2019, I am not sure yet. However, a buying opportunity it is and I have taken advantage through broad based exposure to leading technology names including NFLX, INTC, BKI and AVGO.

The propaganda of fear that is spread so easily throughout the markets in recent years causes inordinately large discounts to take place extremely quickly. These moments in time should be taken advantage of rather than fed into by digesting the information you are seeing as fact. The truth of the matter is that 99% of what is being digested by investors, whether from a legendary fund manager, Wall Street shop or talking head on any financial news network is baseless information that is simply curve fitted around price movement. When price is going up a narrative is created to justify it. When price is going down a narrative is created to justify it. In both case, those narratives are spread as fact while the truth is very often the opposite.

That is the case in late 2018. A majority of the fears we have been led to regard as truth in recent months, at least for Q1 and Q2 of 2019, will be largely unfounded. Technicals just so happen to substantiating this view, especially in recent days, as the character of the market from a price action perspective has changed completely.

I'll have more in coming days.

Have a healthy and happy 2019.

_______________________________________________________________________________

From time to time, I email individual company research, commentary and excerpts from my monthly investor letter to those who are interested. If you would like to receive future emails, please write me at mail@T11Capital.com

Disclaimer

This website is for informational purposes only and does not constitute a complete description of our investment advisory services. No information contained on this website constitutes investment advice.

This website should not be considered a solicitation, offer or recommendation for the purchase or sale of any securities or other financial products and services discussed herein. Viewers of this website will not be considered clients of T11 Capital Management LLC just by virtue of access to this website.

T11 Capital Management LLC only conducts business in jurisdictions where licensed, registered, or where an applicable registration exemption or exclusion exists. Information contained herein is not intended for persons in any jurisdiction where such distribution or use would be contrary to the laws or regulations of that jurisdiction, or which would subject T11 Capital Management LLC to any unintended registration requirements. Visitors to this site should not construe any discussion or information contained herein as personalized advice from T11 Capital Management LLC. Visitors should discuss the personal applicability of the specific products, services, strategies, or issues posted herein with a professional advisor of his or her choosing.

Information throughout this site, whether stock quotes, charts, articles, or any other statement or statements regarding capital markets or other financial information, is obtained from sources which we, and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Neither our information providers nor we shall be liable for any errors or inaccuracies, regardless of cause, or the lack of timeliness of, or for any delay or interruption in, the transmission thereof to the user. With respect to information regarding financial performance, nothing on this website should be interpreted as a statement or implication that past results are an indication of future performance.