Every day I go through roughly 200 stocks/indices/indicators, several times per day, looking for signals, attempting to connect dots and ultimately, hoping to find risk/reward situations that create outperformance.

The title Lies, Damn Lies seems appropriate as when the markets want to reveal any kind of truth, they first do so through blatant lies. Conversely, whenever truth appears apparent, there is likely to be deception involved.

These are simply thoughts (some completely random) as I attempt to connect the dots:

- Got shorter as the week progressed last week. This is a difficult spot for the market that presents investors with a terrible risk/reward situation, as opposed to the beginning of the month where risk was negligible and the reward for participation on the long side was shiny.

- Can't emphasize this enough: Understanding the company you keep in the markets is a highly overlooked edge. As it currently stands, the same investors who were making the terrible decisions to sell late last year are trying to buy back the stock they sold here and now. The reason? They have been provided comfort by the market in the form of earnings, the Fed, government reopened and so on. It's an environment that is being made cozy and comfortable for investors so they don't realize that ritualistic castration is about to take place.

- The put/call ratio on Friday fell to some of the lowest levels observed over the past 12 months after spiking to some of the highest levels observed in years just several weeks back. This type of velocity shift in sentiment typically ends up in some type of violent reaction by the markets. It's akin to stumbling upon a monster in its lair.

- This is one case where popular sentiment may actually prove to be correct. Emerging markets look like they are set to outperform this year. It's not at a point where I believe in the emerging markets thesis strongly enough to invest. However, it is worth noting that sentiment and relative value versus developed markets is at historically extreme levels. In other words, emerging markets are a bargain vs. Europe and especially the U.S.

- With the Fed meeting taking place this week and the market largely pricing in a dovish Fed, there is potential for an extreme reaction if they aren't as soft as investors expect. In either case, it seems to be setting up to be sell the news type of event.

- This week is the heart of Q4 earnings. Again, with the markets advancing as they have, the reaction to earnings has the potential to be weighted on the downside. It's a simple probability scenario where prices are likely not accurately reflecting the downward revisions to forward guidance that will take place this week.

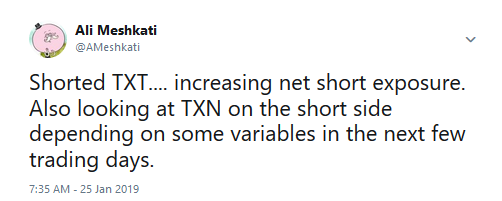

- We're already in distinctly bearish net short position. As the week progresses, I'd like to add weight on the short side. Particularly focused on semis and financials.

- Gold is an enigma currently. From a fundamental standpoint everything points to higher gold prices. I continue to believe that long-term investors will be rewarded pretty massively for their participation in coming years. However, over the short to intermediate term, everyone is now bearish on the U.S. Dollar. Everyone thinks that the Fed is pretty much done. All of this leads me to believe that investors are positioned in the sector to the point that they have opened themselves up for some abuse. Undoubtedly, it's a difficult spot to speculate either long or short. Cross-currents galore.

_______________________________________________________________________________

From time to time, I email individual company research, commentary and excerpts from my monthly investor letter to those who are interested. If you would like to receive future emails, please write me at mail@T11Capital.com

Disclaimer

This website is for informational purposes only and does not constitute a complete description of our investment advisory services. No information contained on this website constitutes investment advice.

This website should not be considered a solicitation, offer or recommendation for the purchase or sale of any securities or other financial products and services discussed herein. Viewers of this website will not be considered clients of T11 Capital Management LLC just by virtue of access to this website.

T11 Capital Management LLC only conducts business in jurisdictions where licensed, registered, or where an applicable registration exemption or exclusion exists. Information contained herein is not intended for persons in any jurisdiction where such distribution or use would be contrary to the laws or regulations of that jurisdiction, or which would subject T11 Capital Management LLC to any unintended registration requirements. Visitors to this site should not construe any discussion or information contained herein as personalized advice from T11 Capital Management LLC. Visitors should discuss the personal applicability of the specific products, services, strategies, or issues posted herein with a professional advisor of his or her choosing.

Information throughout this site, whether stock quotes, charts, articles, or any other statement or statements regarding capital markets or other financial information, is obtained from sources which we, and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Neither our information providers nor we shall be liable for any errors or inaccuracies, regardless of cause, or the lack of timeliness of, or for any delay or interruption in, the transmission thereof to the user. With respect to information regarding financial performance, nothing on this website should be interpreted as a statement or implication that past results are an indication of future performance.