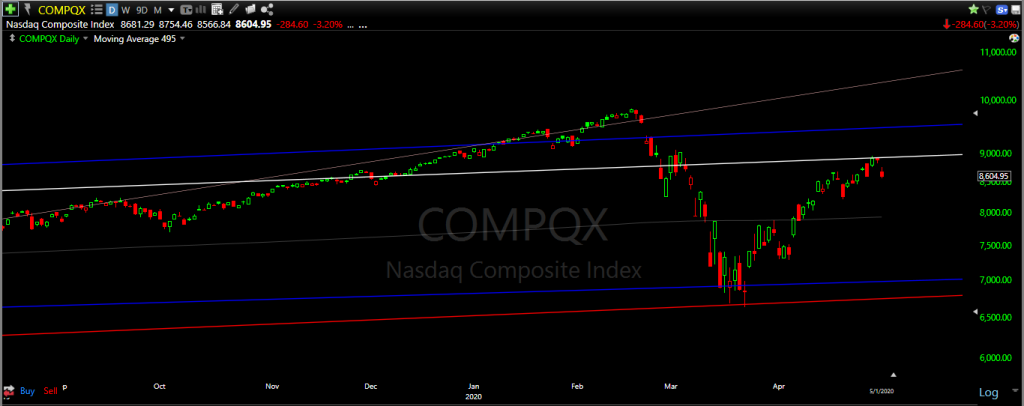

It was bound to happen. Coming into last week I said that resistance for the Nasdaq was 8950. It was going to be the first real resistance point for a major market average since the March lows.

The high for last week on the Nasdaq was 8957 and then this happened.

While I was expecting some type of reaction, with Friday falling in the standard range of expectations, the futures action this Sunday is a little more than expected. We are now pushing the envelope of the 5% maximum peak to trough drawdown on the S&P.

With that said, investors are extremely quick to jump off the bull train. Along the entire path of what I expect to be a much bigger rise than most are expecting, we will experience multiple days of downside volatility that will have investors expecting a replay of March. It won't come.

That makes opportunities like this fleeting in that they provide a tight window for investors to take stock away from the overwhelming majority of weak hands and eager bears who make up the majority of market participants presently. The pullbacks will be steep and violent, but also short-lived in nature.

With that said, a gap down opening on Monday morning is an opportunity to gain exposure, not cut and run, with large cap technology being the favorite target.

We remain long leveraged ETFs from late March and wide variety of mid to large cap tech names.

Zenolytics now offers Turning Points and ETF Pro premium service Click here for details.

Disclaimer

This website is for informational purposes only and does not constitute a complete description of our investment advisory services. No information contained on this website constitutes investment advice.

This website should not be considered a solicitation, offer or recommendation for the purchase or sale of any securities or other financial products and services discussed herein. Viewers of this website will not be considered clients of T11 Capital Management LLC just by virtue of access to this website.

T11 Capital Management LLC only conducts business in jurisdictions where licensed, registered, or where an applicable registration exemption or exclusion exists. Information contained herein is not intended for persons in any jurisdiction where such distribution or use would be contrary to the laws or regulations of that jurisdiction, or which would subject T11 Capital Management LLC to any unintended registration requirements. Visitors to this site should not construe any discussion or information contained herein as personalized advice from T11 Capital Management LLC. Visitors should discuss the personal applicability of the specific products, services, strategies, or issues posted herein with a professional advisor of his or her choosing.

Information throughout this site, whether stock quotes, charts, articles, or any other statement or statements regarding capital markets or other financial information, is obtained from sources which we, and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Neither our information providers nor we shall be liable for any errors or inaccuracies, regardless of cause, or the lack of timeliness of, or for any delay or interruption in, the transmission thereof to the user. With respect to information regarding financial performance, nothing on this website should be interpreted as a statement or implication that past results are an indication of future performance.