While most everyone was convulsing in fear over the ramifications of a debt ceiling debacle, while also being paralyzed by the emotional abuse the market has handed out on a consistent basis for the past 18 months, the Zenolytics team (consisting of just me) ignored the noise, doing what we do best: That is identifying truth in price.

Prior to the acceleration of trend in the NDX and the breakout in the SPX, about 1000 points ago and 200 points ago respectively, on May 18th I published a note on this site titled Here Is Why We Are In The Midst Of The Most Important Move Of 2023, With An Even More Critical Move Being Imminent.

Now that most everyone has realized what we knew weeks ago, there is an argument to be made that the markets will be offended for a short period of time. The offensive nature of what has transpired comes in the form of investors believing that the markets will accommodate their sense of cowardice, by allowing a threat free jump into the water now that the danger of getting bitten by any number of fanged creatures has disappeared.

Debt ceiling behind us.

Earnings better than expected, much to the shock of nearly everyone except for us here.

Fed is quickly moving to the rear view, with economic data having less of an impact.

All of these macro factors are fantastic indicators of intermediate to long-term strength in the markets.

However, over the short-term, the feeling of safety investors have recently experienced must be tested.

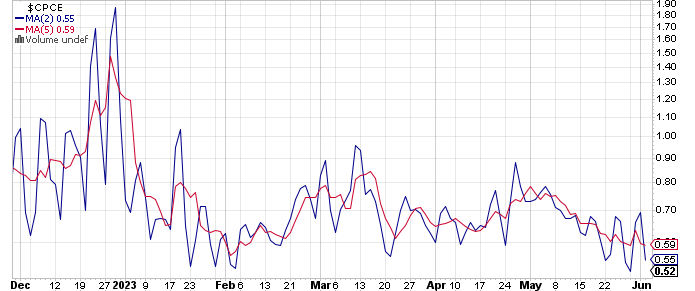

There are numerous examples of investor comfort coming to a crescendo this past week. Here is one with the 2 and 5 day moving averages of the equity put/call ratio nearing their lows for 2023.

And surprise surprise, the last time the put/call was at these levels in early February the S&P was testing the same trajectory we are about to test now.

To be absolutely clear, I remain bullish throughout the remainder of this year. The surprises will continue to be to the upside. However, in the very near-term (next 2 weeks), there could be a bit of turbulence to throw everyone off until the markets begin to gain traction in anticipation of what is to come.

I'll get to what is to come in a future note.

In the meantime, approach new positions on the long side with caution and treat profits with care, while carefully guarding them.

Have a good weekend.

Zenolytics Turning Points is 300+ editions in and only getting better. Find out why institutions and individual investors have come to depend on our service through each and every type of market environment. Click here for details.

Disclaimer

This website is for informational purposes only and does not constitute a complete description of our investment advisory services. No information contained on this website constitutes investment advice.

This website should not be considered a solicitation, offer or recommendation for the purchase or sale of any securities or other financial products and services discussed herein. Viewers of this website will not be considered clients of T11 Capital Management LLC just by virtue of access to this website.

T11 Capital Management LLC only conducts business in jurisdictions where licensed, registered, or where an applicable registration exemption or exclusion exists. Information contained herein is not intended for persons in any jurisdiction where such distribution or use would be contrary to the laws or regulations of that jurisdiction, or which would subject T11 Capital Management LLC to any unintended registration requirements. Visitors to this site should not construe any discussion or information contained herein as personalized advice from T11 Capital Management LLC. Visitors should discuss the personal applicability of the specific products, services, strategies, or issues posted herein with a professional advisor of his or her choosing.

Information throughout this site, whether stock quotes, charts, articles, or any other statement or statements regarding capital markets or other financial information, is obtained from sources which we, and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Neither our information providers nor we shall be liable for any errors or inaccuracies, regardless of cause, or the lack of timeliness of, or for any delay or interruption in, the transmission thereof to the user. With respect to information regarding financial performance, nothing on this website should be interpreted as a statement or implication that past results are an indication of future performance.